2023

Global Onshore Wind Market Report

Key Regional Markets

Spain

Onshore Wind Capacity

15.3 GW

GDP (Current Prices) USD (2022) | 1,400.52bn |

GDP Growth Forecast (constant prices) (2023-2027) | 1.78% |

Currency | Euro |

Country Credit Rating (S&P) | A |

Renewable Energy capacity (2022) | 67.9GW |

Onshore Wind Share in Renewables (2022) | 43% |

Renewable Energy Target | Achieve 74% of electricity supply from renewable sources by 2030 with 160GW of installed renewable capacity |

Spain is one of Europe’s forerunners in renewable energy, with 68GW of cumulative installed base, accounting for 58.2% of the total electricity mix (IRENA, 2023). Onshore wind leads among all renewable technologies (ranks second in Europe after Germany), as market-led auctions and investments assist in developing a steady pipeline of projects. In association, the Spanish government is committed to achieving 160GW of installed renewable capacity by 2030 with 59GW of onshore wind (Recharge News, 2023). To move further, the government has initiated plans to ease the convoluted permitting process by streamlining environmental approvals. It also changed grid access rules for hybrid (solar-wind) projects to secure permission quickly and expedite project development (Rodl & Partner, 2022).

Pros

-

Market-led auctions and ambitious targets to decarbonise the electricity grid laid foundation for steady project pipeline

-

Plans to streamline permitting under the Royal Decree-Law 6/2022 are anticipated to drive the market

Cons

-

Largely undersubscribed renewable auction attributable to the failure to deal with increased costs of new renewable energy projects

-

Lack of governmental support in the advent of global inflation and supply chain bottlenecks

Renewable Energy Mix

In 2022, onshore wind generated 43% of the total renewable energy generation. Contrariwise, offshore wind’s share is still negligible and has stagnated at 5MW of cumulative installed capacity since 2013 (IRENA, 2023). Although solar PV witnessed rapid evolution, with more than 3x growth in the last decade, the onshore wind segment has a preceding edge against its competitors. In 2022, about 25% of the total electricity demand was covered by onshore wind, with more auctions in line, supported by other government initiatives, Spanish onshore wind is expected to expand in the coming years (Wind Europe, 2023).

Installed Capacity: Status and Trend

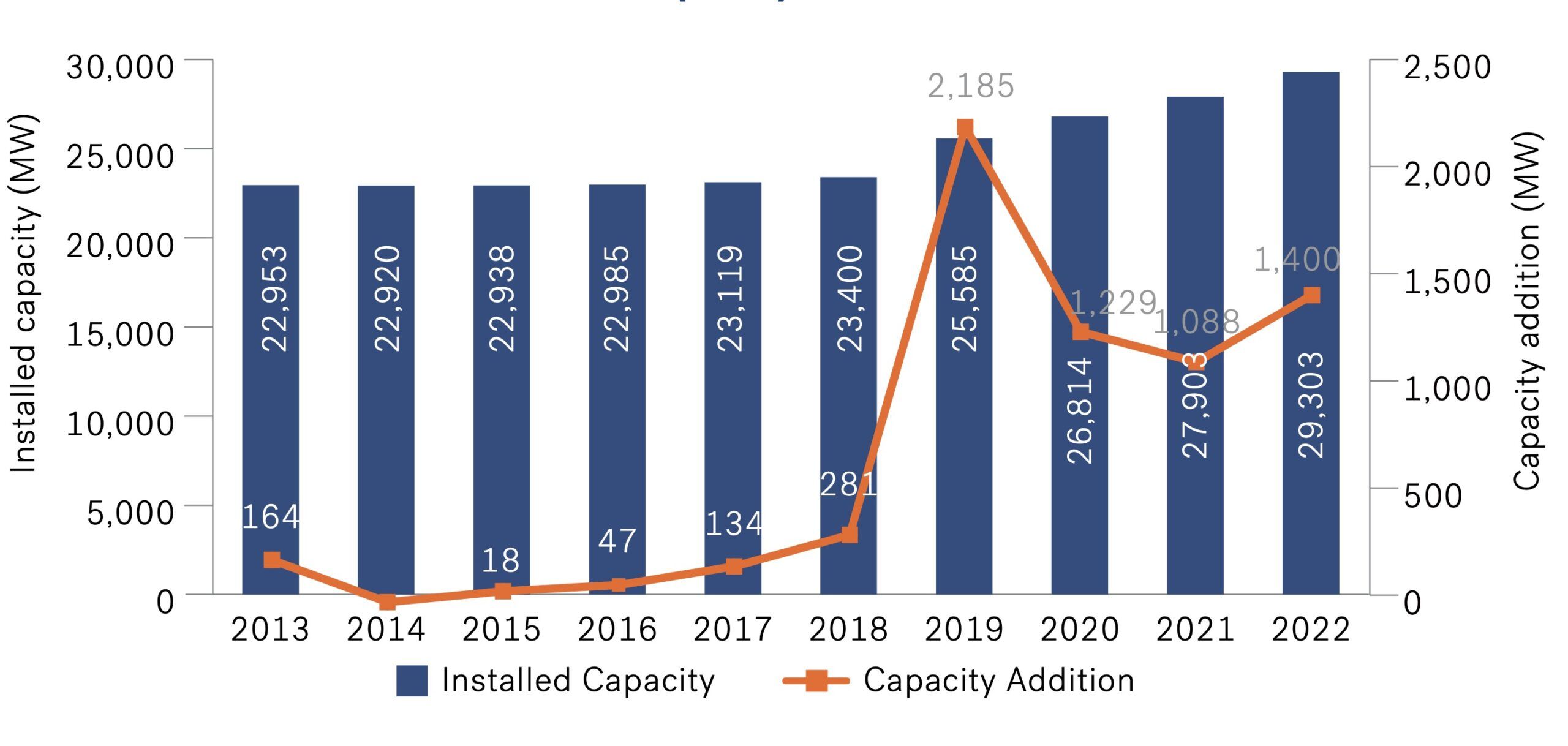

Trend in Installed Onshore Wind Capacity

Source: Preqin Global Report 2023: Private Equity

Although the Spanish onshore wind industry is one of the strongest in Europe, its installed capacity growth indicated a sluggish trend during the first half of the last decade. Between 2013 and 2018, capacity additions were minimal, with a stagnation perceived in cumulative installed capacity. Post-2019, a spike in capacity additions is recorded owing to the commission of projects bid earlier, which dropped in 2020 and beyond due to permit delays and pandemic-related disruptions. However, a spike in installation capacity is expected post-Q22023 as the recently bid projects are anticipated to come online gradually. The government is planning another round of onshore wind auctions, which can further accelerate new additions. Moreover, it is expected that as permitting procedures are streamlined for wind projects in 2023, the existing projects in the permitting phase can add to capacity installations in the coming years (Wind Europe, 2023).

Demand Drivers

The Russia-Ukraine conflict accelerated the initiatives and efforts on renewable energy generation, specifically onshore wind and solar PV, across the EU. Moving in line, in 2023, Spain raised its renewable energy target to 160GW by 2030 from the previous 123GW of installed capacity (Recharge News, 2023). The progress in the targets has been encouraging, considering that the country achieved the targets of 2020 (in terms of share of renewable energy in total consumption). Further progress is observed from over 1GW of onshore wind capacity installations in 2021 and 2022 after additional targets were announced in 2021 to phase out coal energy by 2025, oil power plants by 2030, and nuclear energy by 2035 (Power Technology, 2021).

For a long time, auctions worked as a market-led capacity growth for onshore wind in Spain. The auctions were allocated through a competitive, market-driven mechanism that acted as a driver for project financings. However, a slower permitting process with supply chain bottlenecks and inflations resulted in highly unsubscribed auctions. To deal with permitting delays, the Spanish government mentioned simplifying the project approval procedures through Royal Decree-Law 6/2022. The decree mentions streamlining the environmental approval process of projects with low or medium ecological impact. The changes in permitting rules include mainland wind farms (except for those with self-consumption of less than 100kW), which will accelerate the permitting of wind projects with capacities up to 75MW (Eversheds Sutherland, 2022). As of 2022, about 9.9GW of wind projects are in the permitting pipeline, and with faster approvals, the onshore wind installation capacities are anticipated to expand (Wind Europe, 2023).

The Spanish power sector has been evolving due to its PPA-based renewable contracts. PPA in Spain took off mainly in the post-pandemic era, as manufacturing expansion staggered, and supply chain bottlenecks were reduced. Besides, higher interest rates assisted inflation to fall gradually in the current recessionary phase, signaling a positive outlook to developers for renewables PPA. Yet, the PPA contracts in Spain are mainly for short-term, less than ten years. However, with PPA prices becoming more competitive for buyers, large-scale renewable investment could play a key role in expanding the market. Among wind power PPAs in 2023, notable mentions are 51MW signed between StarKraft and Capital Energy (Renewables Now, 2023) and another 54MW between EDP Renovaveis and Inditex (ZARA) (Renewables Now, 2023).

Market Opportunity

The European Investment Bank’s (EIB) project financings for sustainability and climate change have long contributed to the impetus for corporate investments in the Spanish renewable energy market. In 2022, EIB signed climate action and environmental sustainability-related financings in Spain to support its renewable sector of EUR5.18 billion (EIB, 2023). In March 2023, the EIB signed a EUR55 million green loan for a joint venture between Iberdrola and Caja Rural de Soria to construct a wind farm with a capacity of 100MW in Spain (EIB, 2023). Again, in June 2023, Iberdrola signed a EUR1 billion loan with EIB to fast forward Europe’s energy transition by constructing a portfolio of projects comprising 19 solar power plants and three onshore wind farms in Spain, Portugal, and Germany (EIB, 2023). In this, some projects are aimed to be hybrid with the integration of battery storage systems. In another development, EIB, ICO and Endesa joined forces where EUR500 million of financing has been provided to support Endesa’s current renewable projects and also further expansion plan in Spain (EIB, 2023). Such global finance plays a critical role in accelerating the achievement of renewable energy objectives for the nation.

Over the years, competitive and market-led auctions assisted the Spanish onshore wind to secure broad investment prospects. Despite being technology-neutral auctions, onshore wind’s response was commendable among available options. However, sudden regulatory changes can dampen investor sentiment. For example, in September 2021, a ‘gas tax’ was imposed on windfall gains of wind farms (Windpower Monthly, 2021). It left an impression on investors about the regulatory risk that future projects could face, and consequently, the 2022 auctions remained largely undersubscribed. Despite such outcomes, the Spanish government will auction 1.5GW of onshore wind annually until 2025. This can further strengthen the PPA and merchant markets as permit procedures are further simplified (Wind Europe, 2023).

With the active support for expanding renewable capacity installation, the requirement for transforming the grid infrastructure has also become imperative. Earlier, the authorities approved EUR6.96 billion in investments to construct an advanced network during 2022-2026 to accommodate two-thirds of renewable energy in the grid power supply (IEA, 2022). About EUR1.5 billion could be allocated for the submarine interconnectors with non-mainland territories, while another EUR1.26 billion is expected to be spent for cross-border interconnector lines. Notably, Endesa secured a second round of EUR250 million in financings from EIB for smart grid installation in Spain (Smart Energy International, 2023). In 2023-2025, the company plans to allocate EUR2.6 billion to the distribution networks out of a total investment of EUR8.6 billion.

Outlook

Source: BNEF Global Wind Market Outlook

Spain’s onshore wind project pipeline has been strong due to the momentum generated by successive auctions. The government has planned a series of further auctions, which can bring robust results in the capacity installation base. The BNEF forecasts indicate that from 2023 to 2030, capacity additions to remain above 2GW annually, if attained, can take the onshore wind to above 45GW by 2030. To achieve this, well-structured policy measures coupled with funding initiatives need to be injected.

With the Russian-Ukraine war causing a threat to the global energy market and prices, the urge to meet the rising demand with supply has ignited rapid renewable market growth. Although the onshore wind has key advantages related to cost competitiveness and efficiency in generating power, the demand for utility-scale solar projects can outweigh the onshore wind projects in the future. Competition would only increase over time since Spain will likely pursue technology-neutral bidding instead of having separate auctions for different technologies.

In association, regulatory uncertainty and opposition from local communities due to the associated ecological footprint of wind farms can further hinder the expansion route. Global inflation and supply chain bottlenecks with unsupportive governmental initiatives are triggering unsubscribed auctions in Spain, as evident by its 2022 auction results, with only 45MW of wind awarded out of 1.5GW (Wind Europe, 2023). Again, changes in the grid access rule might create a trail in the previous headwinds, as only hybrid projects are eased.

On a brighter note, merchant and PPA projects, led by a set of utilities through large renewable-based investment funds, can retain the growth impetus of the Spanish onshore wind industry. This indeed needs a stable legislative backup so that the corporate off-takers can make steady inroads.