2023

Global Onshore Wind Market Report

Key Regional Markets

Portugal

Onshore Wind Capacity

15.3 GW

GDP (Current Prices) USD (2022) | 252.38bn |

GDP Growth Forecast (constant prices) (2023-2027) | 1.72% |

Currency | Euro |

Country Credit Rating (S&P) | BBB+ |

Renewable Energy capacity (2022) | 16.3GW |

Onshore Wind Share in Renewables (2022) | 33% |

Renewable Energy Target | Aims to generate 80% of its annual electricity usage from renewable sources by 2026 and carbon neutrality by 2045 |

Portugal has become a leading provider of renewable energy in Europe, with 72% of its energy sourced from renewable technologies as of 2022 (IRENA, 2023). The recent Russian invasion of Ukraine caused energy prices to rise, which further emphasized the need for Portugal to decarbonize and become self-sufficient. The country’s clean energy mix mainly comprises RE hydropower, followed by onshore wind and solar, accounting for 95% of the total renewable energy production that helped reduce its dependence on energy imports to below 80%. To speed up the process, the Portuguese government has advanced the 80% electricity consumption target from 2030 to 2026 (Electrek, 2022). Currently, wind energy accounts for about 26% of electricity consumption, which is primarily generated from onshore wind (Wind Europe, 2023). Portugal’s onshore wind industry has recently made significant progress by implementing strict capacity targets, supportive funds, and well-structured policy initiatives.

Pros

-

Advancing carbon neutrality and electricity generation targets by 5 and 4 years respectively, for rapid transition

-

Released laws to streamline permit and approval process for onshore wind, repowering projects and hybrid projects

Cons

-

A major shift in policy designs and funding initiatives for solar PV and offshore wind

-

Increased local opposition and land availability constraints caused logjams in onshore wind deployment

Renewable Energy Mix

Over the past ten years, the proportion of renewable energy sources used in power generation has increased by 16.5%. Among these renewable sources, hydropower has been the largest contributor, accounting for 46% of the total in 2022. Onshore wind comes in second with a 33% share, followed by solar PV with 16%. However, the proportion of onshore wind has declined by 7% from 2012 to 2022 (IRENA, 2023). This is due to problems with inefficient grid infrastructure, land planning, and the delayed permitting process. Additionally, the increased deployment of solar PV has contributed to this decline. On the other hand, offshore wind has been gaining momentum in recent years and is expected to grow further.

Installed Capacity: Status and Trend

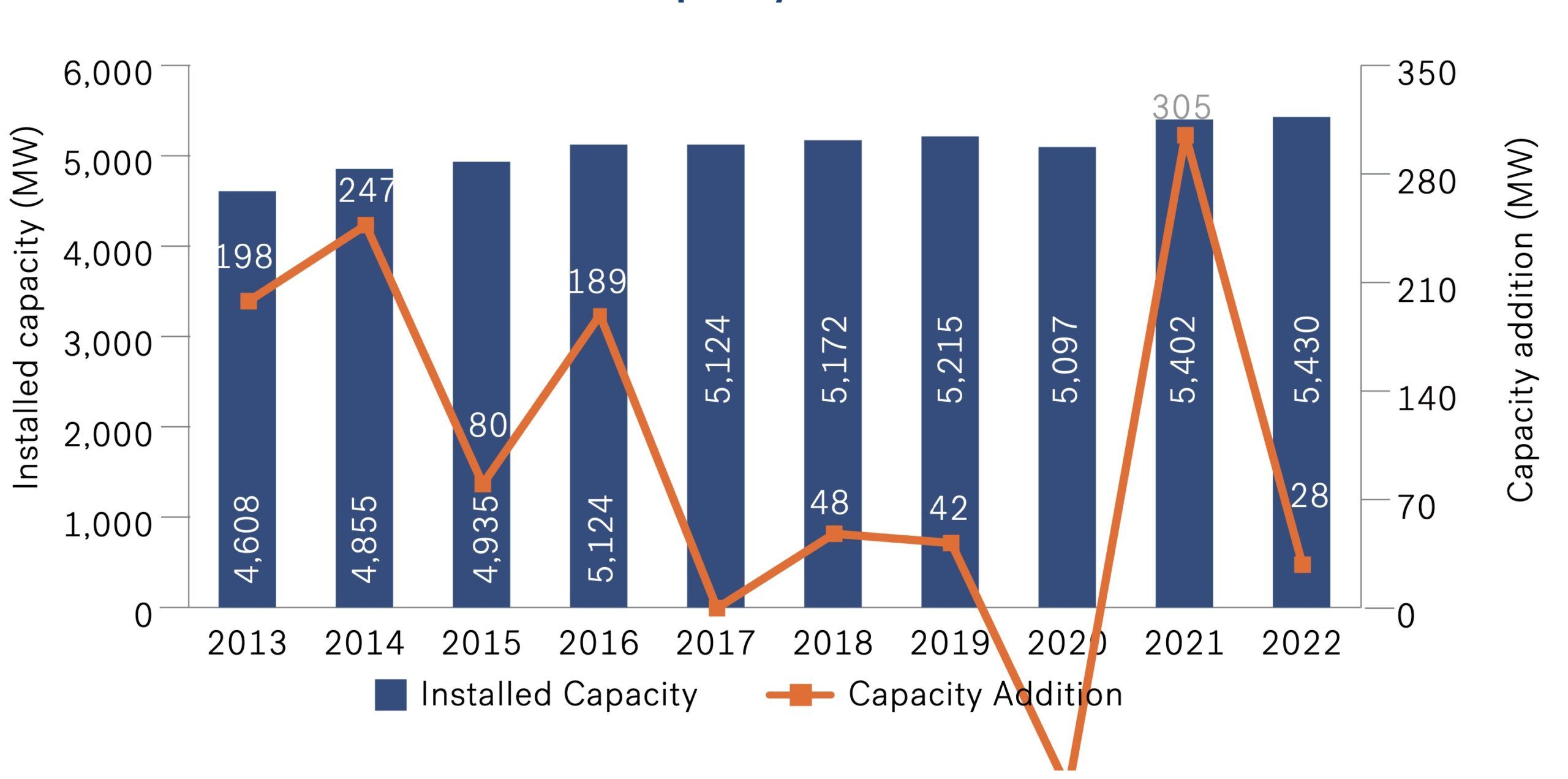

Trend in Installed Onshore Wind Capacity

Trend in Installed Onshore Wind Capacity

Source: Preqin Global Report 2023: Private Equity

Over the last decade, there has been a significant fluctuation in the yearly addition of onshore wind power capacity. The pandemic caused record drops in capacity additions, but in 2021, the momentum was regained and reached 305MW, which is one of the highest in the last nine years (IRENA, 2023). This was made possible by The Economic and Social Stabilisation Program, with a budget of EUR4.5 million, which was launched in H2’2020 (IISD, 2020). However, in 2022, annual capacity additions amounted to only 28MW as renewable policies are now mostly focused on the development of solar PV. The annual increase in installed solar capacity between 2021-2022 was 54% (IRENA, 2023). Additionally, auctions and policy attention were diverted away from onshore wind due to the shift in focus towards offshore wind capacity. Despite these challenges, the onshore wind sector is expected to grow as permit procedures have been simplified under Decree-Law No. 30-A/2022, and with prices becoming more affordable, the sector has become an attractive investment option (Chambers and Partners, 2023).

Demand Drivers

Portugal has historically had a supportive policy framework for onshore wind energy. However, legislative changes and increased competition have limited its expansion capabilities. To address this, Portugal has revised its carbon neutrality targets for a rapid transition. In 2022, it announced that it would renew its 80% clean energy in electricity production target from 2030 to 2026 (Electrek, 2022). Additionally, it plans to amend its ‘Roadmap to Carbon Neutrality 2050’ to 2045, five years ahead of the initial target (EURACTIV, 2022).

To achieve its goals, Portugal aims to reach 10.4GW of onshore wind by 2030, which is an increase from its previous estimate of 9GW (Recharge News, 2023). This translates to approximately 715MW of annual capacity additions. To accomplish this, the Portuguese government plans to mobilize €25 billion in funds over the next ten years for renewable capacity expansion. Moreover, it aims to attract another €75 billion in investments (Recharge News, 2023). While the funding is not specifically designated for onshore wind, it has a significant potential for development compared to other technologies.

The process of securing environmental licensing for onshore wind farms is complex, which is hindering the expansion of onshore wind energy. To address this issue, the Portuguese government introduced Decree-Law No. 30-A/2022 at the beginning of 2022. This law has simplified some licensing steps, resulting in increased production (Lexology, 2022). It is a temporary measure that allows power plants to operate without an operation license or certificate as long as the grid operator ensures the grid injection conditions. Another change is that Portugal no longer requires an Environmental Impact Assessment (EIA) for wind stations located more than 2 km apart, which has helped to speed up permit procedures. Furthermore, the government has announced another plan, Decree-Law No. 15/2022, which aims to optimize repowering wind farms and hybridizing projects (Lexology, 2022). This streamlined permitting process will focus on solar-wind hybrid projects because of their potential to overcome land availability issues.

The 2026 binding renewable target will drive the future deployment of onshore wind energy, as solar PV and offshore wind alone will not be enough to meet the requirement, even though they have received more policy attention than onshore wind in recent times.

Market Opportunity

Portugal offers significant economic advantages for investors and foreign energy companies to operate without market and trade restrictions. The government has promoted a market for renewable energy, which attracts foreign institutions and corporations for investment. In early 2021, the European Investment Bank (EIB) and BPI provided EDP Renováveis with €112 million in funds to build and operate two wind farms in Portugal with a total capacity of 125MW (European Commission, 2021). In September 2023, the European Commission enabled funds of €22.2 billion for a recovery and resilience plan, out of which about 41.2% is allocated to attain climate goals to improve energy efficiency through the expansion of renewables, including cost-effective onshore wind (European Commission, 2023).

Apart from regulatory and lending institutions, companies receive assistance from international lenders to raise funds to develop projects in advantageous locations to meet their decarbonization targets. For example, Aquila Clean Energy raised €1 billion from EIB under InvestEU to develop 50 onshore wind and solar PV projects in Portugal and Spain. The total investment accounts for €2 billion with a total capacity of 2.6GW (European Commission, 2022). This indicates an increased presence of international energy producers in the Portuguese renewable sector, joining hands to bridge the investment gap for renewable project expansion. Furthermore, after streamlining licensing procedures, hybrid (Solar-Wind) projects are gaining significant traction to generate larger volumes in limited land. To this, an investment of €600 million in a hybrid project was announced in 2022 by Endesa Generación Portugal, combining solar, wind, green hydrogen and a 168.6MW battery energy storage system (BESS) as a replacement for Portugal’s last coal power station (Energy Storage News, 2022).

Attention is also being given to improving the grid infrastructure and transmission networks to accommodate the increased capacity building of renewable projects. The EIB has already announced lending €450 million to a Portugal-based energy company, Redes Energéticas Nacionais (REN), to upgrade the transmission network (EIB, 2023). This aims to enhance efficiency and modernize the electricity transmission to handle the deployment of 4.2GW of extra capacity by 2026. Such initiatives can raise the penetration of renewables in Portugal.

Another segment that has assisted in the growth of renewables in Portugal is the PPA (power purchase agreement) and merchant power projects. Although the PPA market has recently been skewed towards solar PV and offshore wind, the onshore wind sector has the potential to take off and show a strong presence on the back of declining project costs.

Outlook

Projected Onshore Wind Builds

Source: BNEF Global Wind Market Outlook

The potential expansion of Portugal’s onshore wind sector is being hindered by competition from other renewable technologies. According to BNEF predictions, annual installations of onshore wind will remain below 500MW and will not make significant progress until 2030.

Significant funds and initiatives are being directed towards solar energy, such as the “Vale Eficiência” program (an efficiency voucher program) and the “Apoio Edifícios + Sustentáveis” (Support + Sustainable Buildings program) designed to support solar PV installations (Fundo Ambiental Portugal, 2023). Similarly, 1GW of auctions are designated for offshore wind in Portugal (Renewables Now, 2023). Such initiatives are attracting robust financing for solar park construction and the expansion of offshore and floating wind farms, indicating a clear shift of resources and capital away from onshore wind. Furthermore, opposition from local communities due to the ecological footprint and the health impact of wind farms adds to the challenges in granting licenses for large-scale wind projects.

To tackle these challenges, the Portuguese government has streamlined the licensing procedures. Additionally, the government has allowed grid expansion through tenders, resulting in investments in the upgrading of grid transmission and providing a positive outlook for energy developers. Further, the growth prospects for hybrid solar are expected to provide a turnaround for the industry as the government proposes hybridization initiatives. Another notable market segment is repowering, as Portugal has the oldest wind fleets, which could be repowered, signalling an opportunity for OEMs.

Regardless of the headwinds, the onshore wind sector can increase its capacity by addressing some of the prevailing obstacles through regulatory reforms to assert the technology’s substantial role in the decarbonization of the Portuguese power system.